accurate predictions from proprietary data

Our proprietary alternative data powers our prediction algorithms to beat all major equity indexes. Consistently.

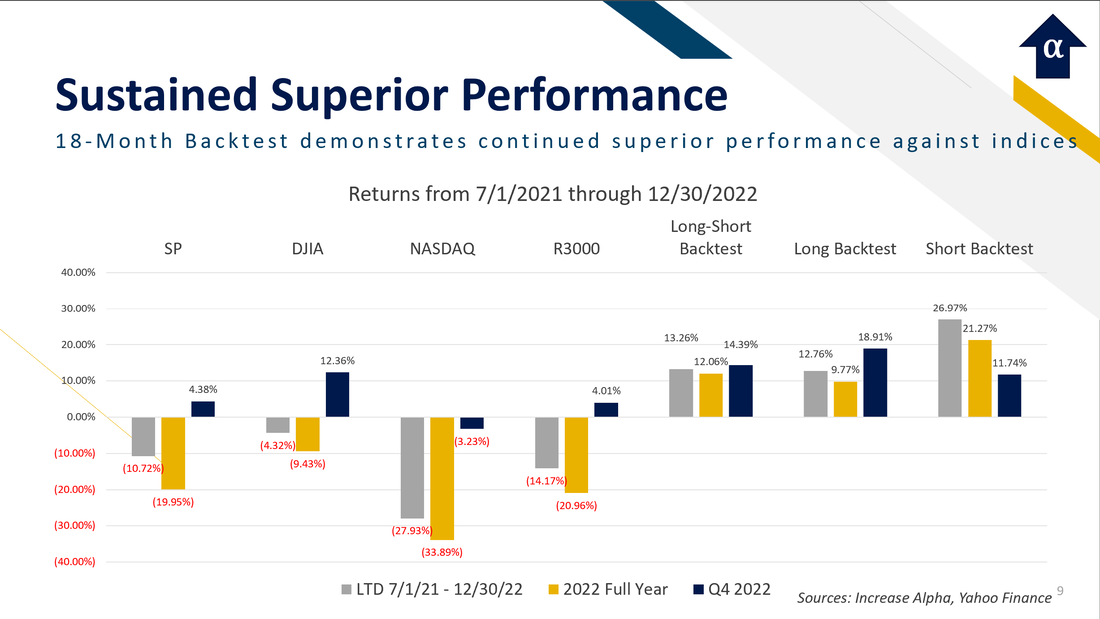

Since we began running our predictions in July, 2021 we have outperformed the S&P 500 by 24%. We gained 13.3% while the S&P 500 lost 10.7%. In fact, while the S&P, Dow, NASDAQ, and Russell 3000 all dropped in value over this period, all three of our trading strategies gained. See the chart for a detailed comparison.

How did we do this? Our proprietary NLP and Machine Learning algorithms extract data from publicly available sources to create a proprietary set of metrics and trading rules that enable us to consistently and dramatically outperform our competitors and benchmarks. We create 10 day rolling forecasts of price predictions for over 800 of the Russell 3000 companies with a market capitalization of at least $2 billion. These forecasts are combined with our proprietary trading rules and then executed daily to generate stable and consistent returns.

We don't trade on news sentiment, momentum, conduct high frequency trades, or even use any options or derivatives. Our gains are through simple long and short trades that are held for an average of 4 days.

Talk and words are cheap. The proof is in the predictions.

Our daily live predictions for our entire coverage list is available for your inspection in the interactive chart below. Simply select the ticker and you can see how our predictions have performed against the actual close prices.

Our data is now available for licensing by institutions and available to retail traders at Alpha Wolf.

Contact us at [email protected] to learn more.

Since we began running our predictions in July, 2021 we have outperformed the S&P 500 by 24%. We gained 13.3% while the S&P 500 lost 10.7%. In fact, while the S&P, Dow, NASDAQ, and Russell 3000 all dropped in value over this period, all three of our trading strategies gained. See the chart for a detailed comparison.

How did we do this? Our proprietary NLP and Machine Learning algorithms extract data from publicly available sources to create a proprietary set of metrics and trading rules that enable us to consistently and dramatically outperform our competitors and benchmarks. We create 10 day rolling forecasts of price predictions for over 800 of the Russell 3000 companies with a market capitalization of at least $2 billion. These forecasts are combined with our proprietary trading rules and then executed daily to generate stable and consistent returns.

We don't trade on news sentiment, momentum, conduct high frequency trades, or even use any options or derivatives. Our gains are through simple long and short trades that are held for an average of 4 days.

Talk and words are cheap. The proof is in the predictions.

Our daily live predictions for our entire coverage list is available for your inspection in the interactive chart below. Simply select the ticker and you can see how our predictions have performed against the actual close prices.

Our data is now available for licensing by institutions and available to retail traders at Alpha Wolf.

Contact us at [email protected] to learn more.